Global Pharmacy Market Report - By Product Type (Prescription and OTC), By Pharmacy Type (Retail and ePharmacy), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Aug 2025

- Report ID: 95930

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

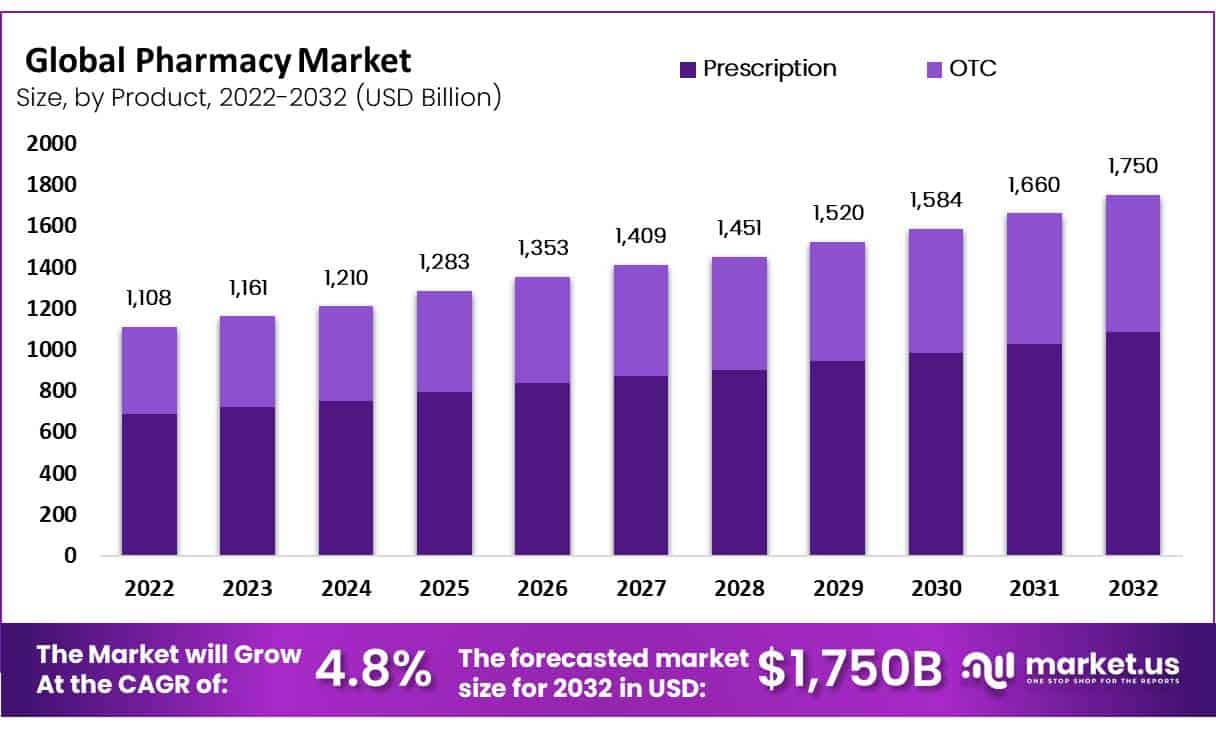

The global pharmacy market size is expected to be worth around USD 1,750 billion by 2032 from USD 1,108 billion in 2022, growing at a CAGR of 4.8% during the forecast period from 2022 to 2032.

The Key factors that boosted the market are the rising aging population, the increasing number of prescriptions, and the increasing number of people suffering from diseases. According to the National Health Services, in the financial year 2020-2021, the cost of medications rose by 3.5% compared with the reports in 2019-2020 in England.

In the US, around 45.6% of the population consumed no less than one prescription drug between 2015-2018, according to the Centers for Disease Control and Prevention report.

Rapid upgradation and expansion of current pharmacies to enhance market penetration have positively impacted the pharmacy market’s growth. Significantly, in the fiscal year 2020, Rite Aid Corp.

relocated five stores, opened two new stores and completed the remodeling of stores to achieve 1,824 remodeled stores. In addition, hospital pharmacies and Retail are rapidly accepting various automation devices to enhance patient safety and provide accurate and rapid patient services.

For example, automation systems are vastly used in automated prescription pick-up, e-prescribing bar code verification, automated pill counting, point-of-sale programs, and interactive voice response systems.

Key Takeaways

- Market Growth: The global pharmacy market is growing at a CAGR of 4.8%.

- Factors Driving Growth: The market is boosted by the rising aging population, increasing prescriptions, and the prevalence of diseases. In England, medication costs increased by 3.5% in the fiscal year 2020-2021.

- Prescription Medications: The prescription segment dominated the market due to the growing aging population and the prevalence of chronic diseases such as diabetes and cardiovascular disorders.

- OTC Segment: Over-the-counter (OTC) medications are expected to have the highest CAGR, driven by demand for oral analgesics, heartburn medications, and upper respiratory medications.

- Pharmacy Types:

- Retail pharmacies were leading in 2022 due to the rise of independent and chain pharmacies, technological advancements, and increased demand during the COVID-19 pandemic.

- E-pharmacies are on the rise, offering benefits like free shipping, privacy, and discounts.

- Distribution Channels: Hospital pharmacies hold the major share, driven by increased patient visits and hospitalizations during the COVID-19 pandemic. Retail pharmacies and online pharmacies are also significant segments.

- Drivers: Growing prevalence of chronic conditions and increasing patient populations worldwide.

- Restraints: Some patients may experience side effects, leading to product recalls and affecting brand reputation.

- Trends: Decentralized clinical trials gained prominence due to COVID-19 restrictions, and pharmaceutical companies collaborated with AI-driven firms for patient care and automated clinical trials.

- COVID-19 Impact: The pandemic initially disrupted the pharmaceutical market but had a short-term effect as pharmaceutical companies adapted to challenges.

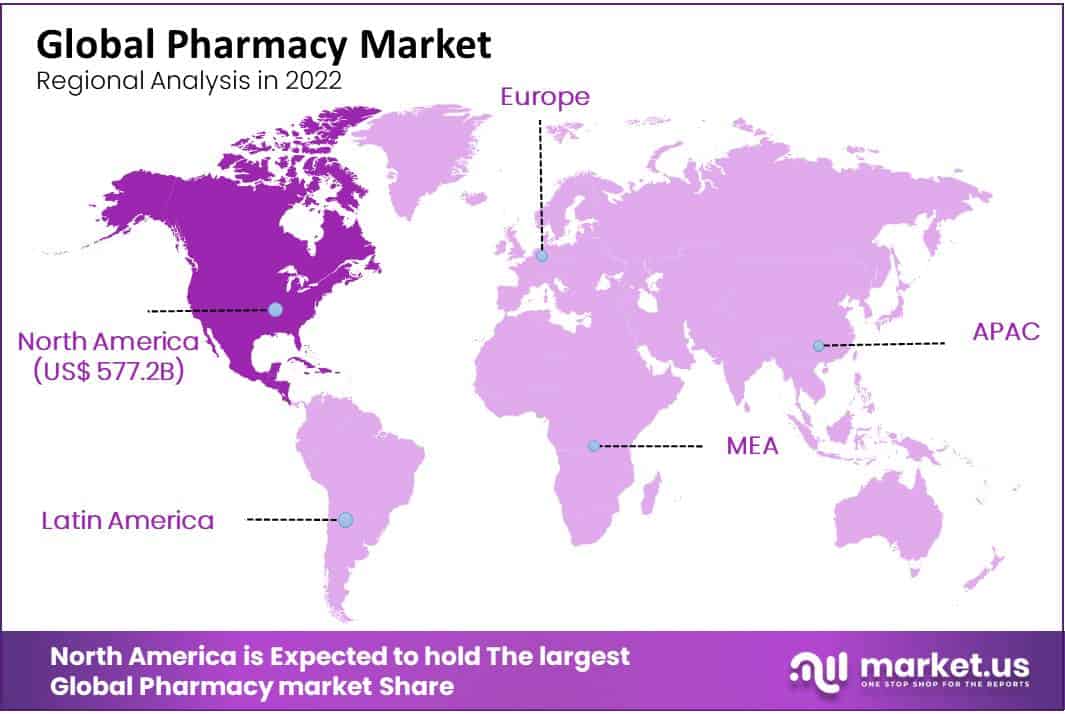

- Regional Analysis:

- North America dominates the market (52.2% revenue share in 2022) due to key players like Walgreens Boots Alliance and CVS Health, along with a growing aging population.

- Asia-Pacific (APAC) is expected to be the fastest-growing region due to the pharmaceutical industry’s rapid growth in countries like India and China.

- Key Players: Major players focus on research and development, collaborations, and acquisitions to strengthen their market position. Key companies include Medly Pharmacy, CVS Pharmacy, Amazon Pharmacy, and others.

Product Type Analysis

The prescription segment accounted for the highest revenue share in 2021. The factor that drives the demand for prescription medications is the growing aging population and the rising stress of chronic diseases, which leads to segment growth.

According to the International Diabetes Association, in 2019, 463 million adults had diabetes. As per the reports American Heart Association, between 2015-2018, 126.6 million Americans suffered from cardiovascular disease. Furthermore, the global geriatric population is also expanding rapidly.

Therefore, increased demand for prescription drugs for therapies, such as cardiovascular disease, respiratory disorders, blood disorders, oncology, and diabetes, is a crucial factor for the segment’s growth.

The OTC segment is also estimated to have the highest CAGR during the forecast period. The rising demand for OTC medications for diseases, such as oral analgesics, heartburn medications, and upper respiratory medications, drives the segment’s growth. Also, increasing viral infections due to flu, cough, and cold support the segment’s growth.

Pharmacy Type

In 2022, the retail pharmacy was a leading segment and collected the largest revenue share. The rise in the number of independent pharmacies and chains with the accessibility to medications in mass retailers as well as supermarkets in countries like The US and the UK drives the retail pharmacy segment.

Due to large chains like Well pharmacy, CVS Health, UnitedHealth Group, Kroger, Rite Aid Corporation, Shoppers Drug Mart, Albertsons Companies, Walgreens Boots Alliance, and Lloyd Pharmacy in various countries, like the UK, Russia, Australia, The US, and Canada, the pharmacy market size is rising which results in pharmacy market growth.

Furthermore, implementing automation technologies, like dispensing, packaging systems, and robots are driving the segment’s growth. CVS Health Corporation offers different health management programs and services to lower disease burden or stress.

In 2020, so many pharmacies witnessed an enhancement in revenue growth during the Covid-19 pandemic. Specifically, online sales of Boots UK enhanced by around 105% during a lockdown. According to CVS Health, there is a 50% growth in digital refills in the specialty product category through apps.

E-pharmacies have various benefits, such as free shipping, privacy and confidentiality, discounts, a vast range of offers, and reduced purchase time. Furthermore, the increase in implementation of digital technologies by the healthcare industry, a growing amount of retailers introducing online channels, and increasing penetration of smartphones are enhancing the segment’s growth. As the customer volume increases, the responsibility for customer satisfaction also increases.

Key pharmacies were focused on providing medications, vaccinations, and kits for COVID-19 during the pandemic. In the global industry, key stakeholders undertaking strategic initiatives, along with the increasing disease burden and the rising aging population, it estimates to drive pharmacy market growth.

Distribution Channel

As per the distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment holds the major share in the market due to the increasing patient visits to treat disease conditions. Also, the segmental growth was due to increased hospitalizations during the COVID-19 pandemic, specifically in Emergency departments and Intensive Care Units (ICU).

On the contrary, the rising preference of patients toward specialty clinics is growing due to the growing adoption of technological advancements with specialized treatment and care in specialty clinics. These are some main factors contributing to the retail pharmacies’ growth.

The online pharmacy segment is expected to have the largest CAGR over the forecast period due to the penetration of online websites and portals, such as Walmart, Amazon, and others, into this industry.

Key Market Segments

Based on Product Type

- Prescription

- OTC

Based on Pharmacy Type

- Retail

- ePharmacy

Based on Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Growth in the prevalence of chronic conditions

The growing global prevalence of chronic conditions like diabetes, cancer, and others results in an increased patient population in the healthcare system. Also, the rising geriatric population is leading to a growing prevalence of age-related disorders like cardiovascular disorders, congestive heart failure, rheumatoid arthritis, immune deficiencies, viral hepatitis, oncology, anti-diabetes, autoimmune diseases, and others.

With the growing awareness and prevalence of infectious diseases and chronic conditions among people, the patient population requiring personalized therapies, vaccines, and drugs is also rising. Moreover, growing per capita healthcare expenditure in emerging and developed countries increase the number of patients undergoing treatment.

Restraints

Some Side effects may be seen in patients due to some factors.

The vaccines and drugs are vigorously tested for efficacy and safety through clinical trials before making them available. However, wherever clinical trials are performed on a small number of candidates for a short period, most of the time, specific side effects are seen in the patients at an initial stage because of their age, immunological factors, and other factors.

Also, because of mislabeling, poor manufacturing of the products, or potential contaminants, the drug was recalled from the market, hampers the market players’ brand value. It affects their sales, reputation, and customer relationships.

Trends

Some of the factors mentioned below were responsible for the pharmacy market’s growth.

Due to the factors such as COVID-19 restrictions, including quarantine, social distancing, etc., and fear of getting infected, the pharmaceuticals market led to enhance adherence to decentralized clinical trials.

These factors hindered the clinical trials’ productivity, efficacy, and outcomes. It increased demand for decentralized clinical trial processes, patient selection, and enrollment to study the trial outcomes.

The growing demand increased the corporation among pharmaceutical companies with Al-driven companies to enable patient care delivery models and Al-driven companies to enable automated clinical trials.

Regional Analysis

North America dominates the global pharmacy market.

North America accounted for the largest revenue share of 52.2% among the other countries in 2022. Large-scale chains like Walgreens Boots Alliance Healthcare Business, CVS Health Corporation, United Health Group, Rite Aid Corp, and Cigna approve it.

These key players apply different strategies and initiatives to enhance their market share. Furthermore, the senior population is responsible for the growth of the market.

As per the report published by the US Census Bureau in June 2020, the population above 65 increased from 34.2% between 2010-2019. The rapidly growing demand for prescription drugs and OTC drives market growth potential.

Despite that, APAC is expected to be the fastest-growing regional market during the forecast period. Due to the rapid growth in the pharmaceutical industry and generic medications in India and China, the market can be driven in this region.

Another factor that may cause the market is the rising older population in Asian countries like Japan.

Key Regions

- North America

-

- The US

- Canada

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Mexico

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The factors that strengthen the market position of Key players are growth strategies and a strong product portfolio. The major players focus on enhancing their research and development process of novel therapies to meet the demand of the patient population.

Additionally, growing collaborations and other factors, such as acquiring players to strengthen their portfolio, are major factors through which there will be an increase in revenue growth. Various diabetes program was run by different organizations that spread awareness about diabetes and diabetes medicines.

Several retail pharmacy businesses, medical stores, and digital pharmacies are in the market. Medly Pharmacy, Mortar Pharmacies, Lloyd Pharmacy, Humana Pharmacy Solutions, Amazon Pharmacy, Kroger Rite Aid Corp., CVS Pharmacy, Boots U.K., Matsumoto Kiyoshi, Walgreens Boots Alliance, Inc., and others are a few key companies that contribute to the market growth.

Below are some of the most prominent global pharmacy market players.Market Key Players

- Pfizer Inc.

- Johnson & Johnson

- GSK plc.

- Novartis AG

- Merck & Co., Inc.

- Sanofi

- Hoffmann-La Roche Ltd.

- AstraZeneca

- Novo Nordisk A/S

- Other Key Players.

Key Industry Development

- In June 2022, for the VAXNEUVANCE vaccine, Merck CO., Inc. received the approval of the USFDA for the treatment of invasive pneumococcal disease in infants and children.

- May 2022, GGK plc. Acquired Affinivax, Inc. It is a clinical-stage biopharmaceutical company to strengthen the company’s vaccines R&D pipeline, expand its geographical footprint in the Boston area, and provide access to new technology.

- In May 2022, the European Commission (EC) approval of the CARVYKTI was received by Johnson & Johnson Services.

- In January 2022, USFDA approval was received by Hoffman-Ltd. to treat diabetic Macular Edema (DME).

Report Scope

Report Features Description Market Value (2022) US$ 1,108 Bn Forecast Revenue (2032) US$ 1,750 Bn CAGR (2023-2032) 4.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Prescription and OTC; By Pharmacy type- Retail and ePharmacy; and By Distribution Channel- Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Pfizer Inc., Johnson & Johnson, GSK plc., Novartis AG, Merck & Co., Inc., Sanofi, F. Hoffmann-La Roche Ltd., AstraZeneca, Novo Nordisk A/S, and other Key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the pharmacy market?The global pharmacy market size was estimated at USD 1,108 mn in 2022 and is expected to reach USD 1,750 mn in 2032

What is the pharmacy market growth?The global pharmacy market is expected to grow at a compound annual growth rate of 4.80% from 2022 to 2032 to reach USD 1,750 million by 2032

Who are the major players operating in the pharmacy market?The major players operating in the pharmacy market are Pfizer Inc., Johnson & Johnson, GSK plc., Novartis AG, Merck & Co. Inc., Sanofi, Hoffmann-La Roche Ltd., AstraZeneca, Novo Nordisk A/S, Other Key players.,

-

-

- Pfizer Inc.

- Johnson & Johnson

- GSK plc.

- Novartis AG

- Merck & Co., Inc.

- Sanofi

- Hoffmann-La Roche Ltd.

- AstraZeneca

- Novo Nordisk A/S

- Other Key players.